The Kuda app has been in the news of late, as it becomes more and more popular as the go-to platform for digital banking and payment processing in Nigeria. However, not everyone knows exactly what it is, or how to download it, so we’ve put together this brief guide to help you get started with Kuda and take your mobile banking experience to the next level!

What’s Kuda App?

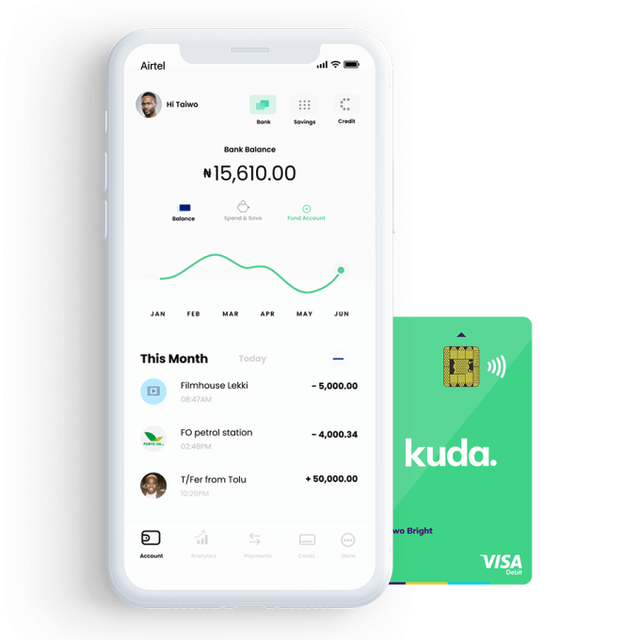

Kuda Bank is essentially a traditional bank with no physical branches. The financial company is entirely online and operates under a legal banking license issued by Nigeria’s central bank. The bank is designed specifically for smartphone users, so potential customers without one will be unable to bank with them. The Kuda bank app can be downloaded on Androids and iPhones.

The Kuda Bank app is simple to use and allows you to conduct banking transactions anywhere and at any time. Because of its user-friendly interface, which allows for easy navigation and execution of the app, anyone with a smartphone can easily use it. It is optimized for quick loading, allowing for faster transactions.

Is Kuda bank a legal entity?

Yes, Kuda holds a Central Bank of Nigeria microfinance banking license (CBN). RC 796975 is their CAC number.

Features of Kuda Bank App

- They do not charge unnecessary bank fees like card maintenance fees, account maintenance fees, and so on.

- Transfer money to your account or another account.

- Payment of Bills.

- Buy airtime and data for your phone

- Request for loan

- Withdraw and transfer funds.

- You can use your free Kuda Card to withdraw money from ATMs.

What are the requirements for opening a Kuda bank account?

- You must be at least 16 years old to participate in this activity.

- A phone number

- An email address

- BVN

- A government-issued ID

How Can I Get the Kuda Bank App?

The Kuda bank app is available for download on Google Play (for Android) and the App Store (for iOS) (for the iPhone). Simply follow the simple sign-up process after downloading, and you’re done.